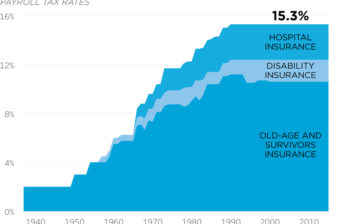

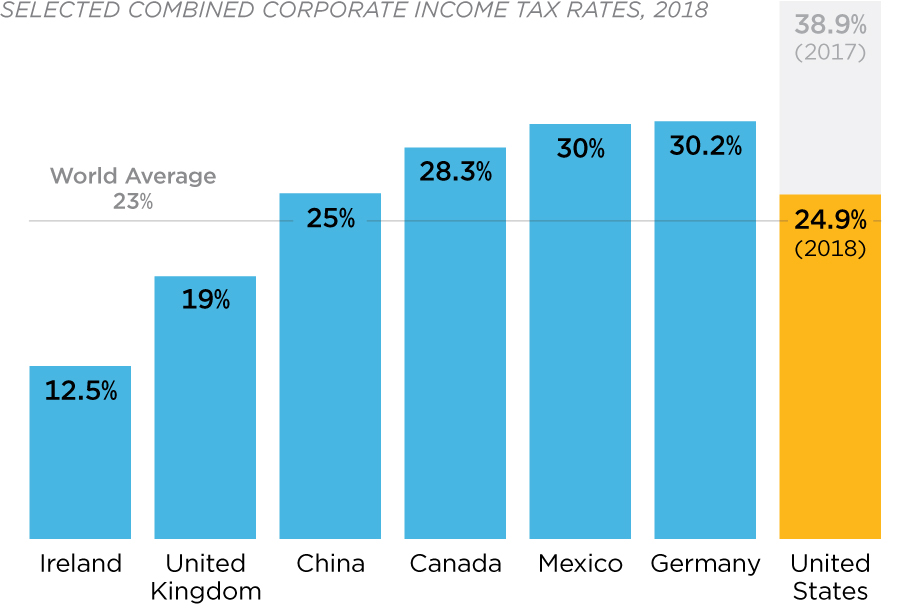

U.S. Cuts Corporate Tax Rate

Tax reform lowered the U.S. federal corporate tax rate. As a result, the combined federal and state U.S. corporate tax rate fell from almost 40 percent—the highest in the developed world—to below 25 percent. The new rate, slightly above the world average, is making America more competitive in the global economy.

Source: OECD