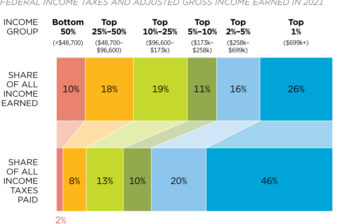

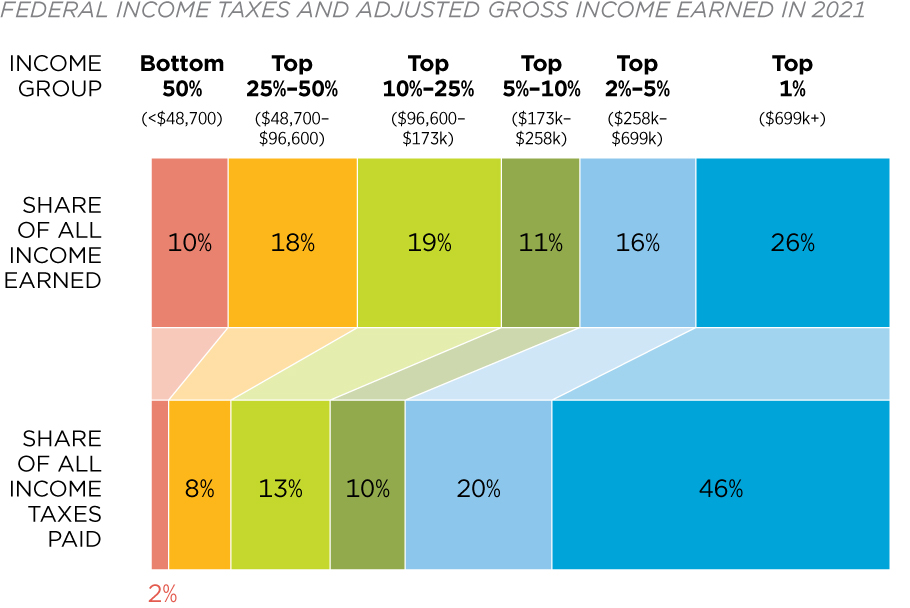

Do the Rich Pay Their Fair Share?

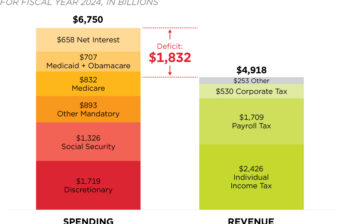

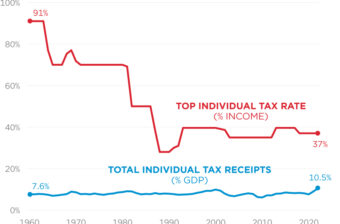

Top earners remain targets for tax increases, but the federal income tax system is already highly progressive. In 2021, the latest year with available data, the top 1 percent of income earners earned 26 percent of all income and paid 46 percent of all federal income taxes – more than the bottom 95 percent combined (33 percent).

Updated June 27, 2024

Source: Internal Revenue Service

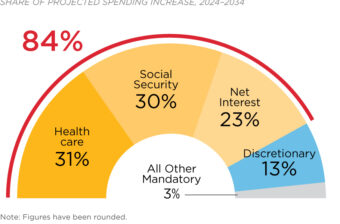

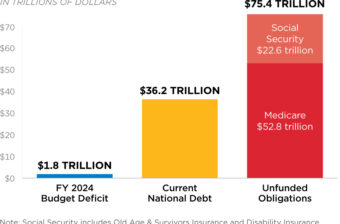

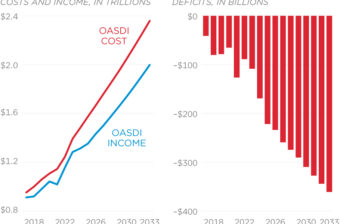

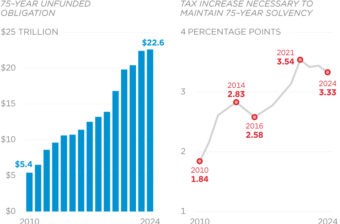

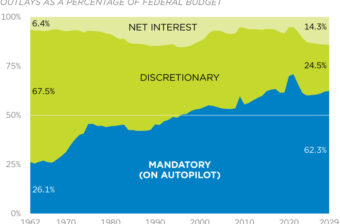

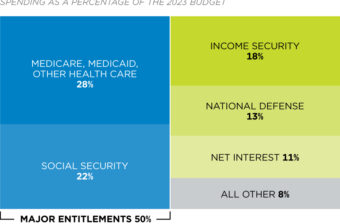

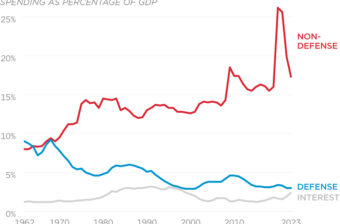

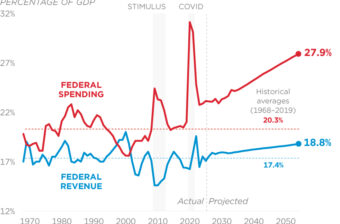

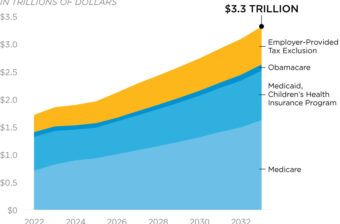

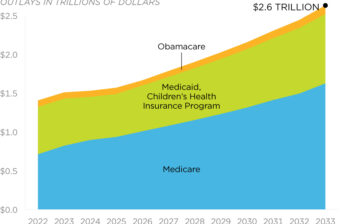

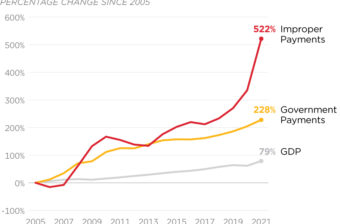

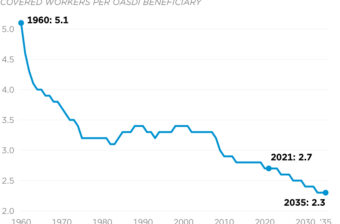

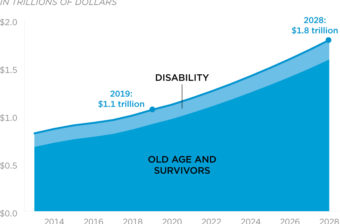

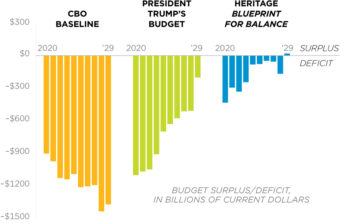

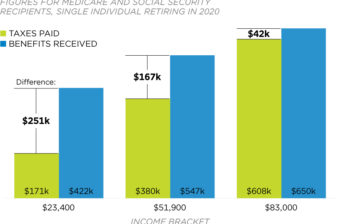

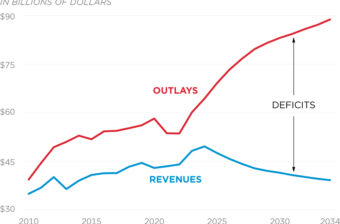

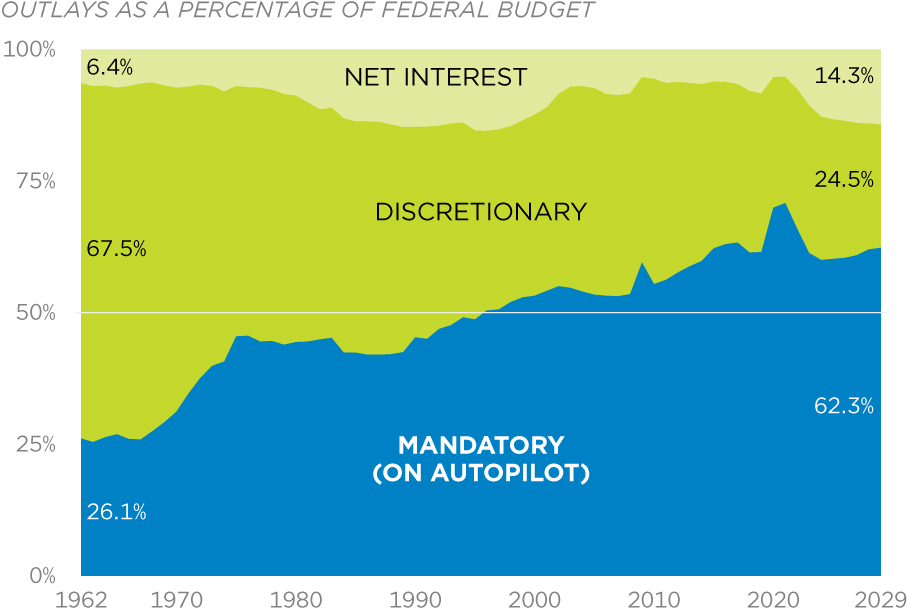

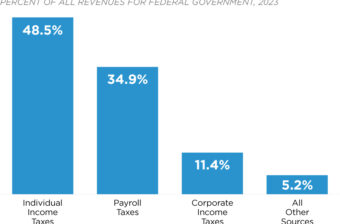

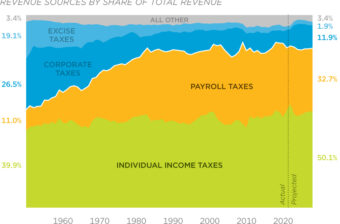

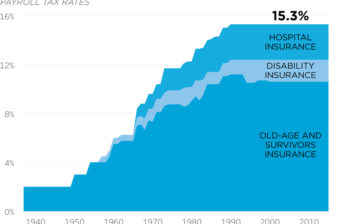

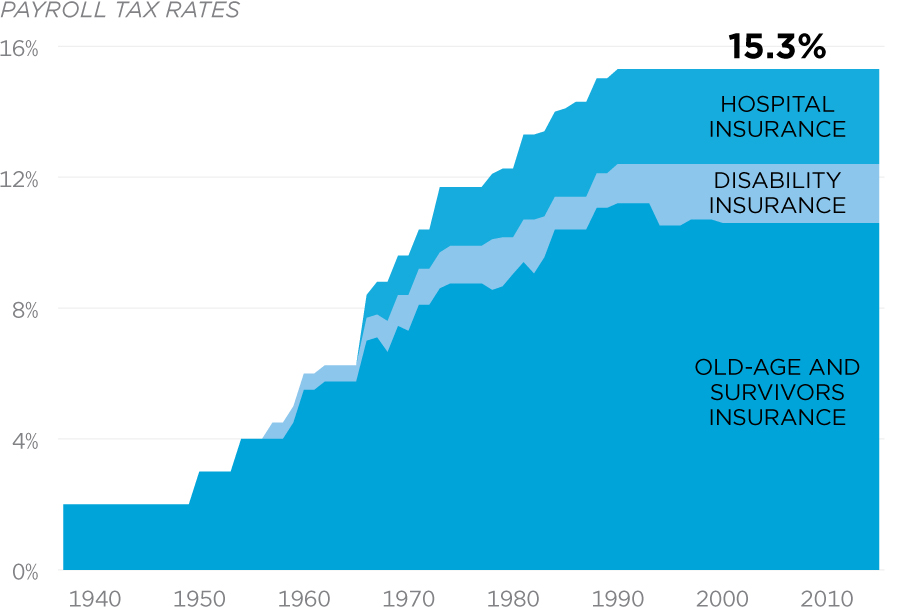

Without reforms, spending on Medicare and Social Security is threatening even higher payroll taxes for workers.

Without reforms, spending on Medicare and Social Security is threatening even higher payroll taxes for workers.